Many Ontario businesses are opening their November electricity bills and asking the same question: why is my November electricity bill so high?

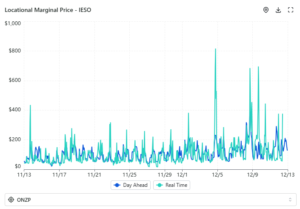

The answer lies in a sharp and unusual spike in Ontario electricity prices over the past two months. November – typically one of the lowest-cost months of the year – ended with an average wholesale electricity price of $82/MWh, higher than every other month in 2025. During periods of tight system conditions, some real-time prices exceeded $500/MWh, driving unexpected cost increases for businesses exposed to wholesale pricing.

For many greenhouses and industrial operations, this has meant an unexpected increase in operating costs that have added significant strain to operating budgets. The story behind today’s price spikes comes down to three major forces working together – two of them typical for winter, and one that is far more impactful this year.

To understand what is driving these price spikes, it’s important to first understand how Ontario electricity prices are set in Ontario for every hour. Below, we will explain how Ontario’s price-setting mechanisms work, break down what is driving these price spikes, and then outline what may change as we move deeper into winter.

How Ontario Electricity Prices Are Set

Ontario’s day-ahead and real-time prices are set by the highest-cost resource needed to supply the next unit of electricity.

This means that for every hour of the day, a market auction is held where supply is matched to demand in order to set the price for that hour. Every supplier that supplies electricity during that hour is then paid that market clearing price regardless of what their bid was. As a result:

- If low marginal cost nuclear and renewables are available, they take on the majority of the load, and encourage lower and more stable electricity prices.

- If Ontario demand is high and the system is forced to call on natural gas generators, especially aging or inefficient generators, their high marginal costs become the market-clearing price for that hour.

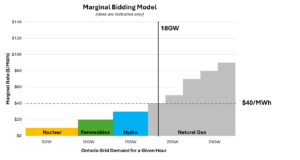

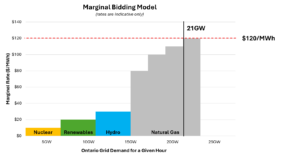

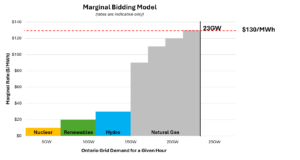

For example, a simplified bidding model is outlined below. The Ontario market is very similar to this, with electricity prices set for each hour of the day, but of course there are far more bidders and added complexity in the real market.

In this simplified scenario, the Ontario demand for the hour is 18GW (18,000MW). The market first selects all of the low or no marginal cost suppliers such as nuclear and renewables, it then selects the lowest cost marginal suppliers such as hydro and more efficient natural gas plants until it reaches enough supply to match demand. In this scenario, supply matches demand at a clearing price of $40/MWh.

Note, all of the rates shown in this scenario are illustrative only.

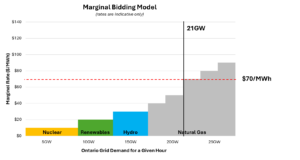

Using this simplified scenario, we can now start to adjust some assumptions to show how that would impact Ontario electricity prices. For example, if the hourly demand increases from 18GW to 21GW on a cold winter day, then the market has to select additional gas plants until supply matches demand again. In this scenario, that occurs when the clearing price reaches $70/MWh.

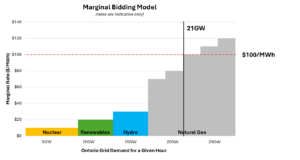

Or, if we assume that natural gas prices increase this would naturally increase the cost of electricity produced by natural gas power plants. As shown below, even if demand stays at 21GW the clearing price now has to reach $100/MWh before supply meets demand.

Or, if some of the nuclear supply and the cheaper natural gas supply goes offline for scheduled maintenance, the cost curve adjusts. Now, with fewer lost cost suppliers available, higher cost suppliers must be called upon in order to match supply and demand. As a result, the clearing price has to reach $120/MWh for this given hour.

With an understanding of this simplified scenario, we can now understand how the market changes in the real world affects Ontario electricity prices.

1. Higher Winter Electricity Demand in Ontario

Every year, electricity demand rises naturally as temperatures drop. Facilities use more heating, ventilation systems run harder, and lighting loads extend into longer evenings.

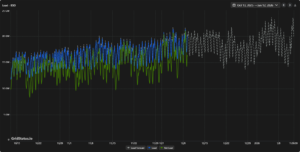

The IESO’s demand forecasts shows exactly this:

- Rising demand through November,

- A small dip during the holiday period, and

- Another climb as we move into January.

This pattern happens every year, but usage is higher this year. In previous years, it was rare for usage to reach 21,000MW in the winter, however we have already seen usage exceeding 21,000MW in November and December with usage expected to climb as high as 23,000MW in January.

As outlined above, as demand increases the market has to select higher cost suppliers in order to match supply and demand, but this does not fully explain the scale of the price jump we’ve seen.

IESO Forecast for Ontario Demand, October 2025 to January 2026

2. Higher Natural Gas Prices

Every year, natural gas prices rise as we enter the winter months and more natural gas is consumed by businesses and homeowners for heating.

Natural gas plays an important role in Ontario’s electricity supply mix. When gas prices rise, the cost of generating electricity rises with them. Even efficient plants become more expensive to operate, and less efficient plants – often the ones called on during tighter system conditions – can become dramatically more costly.

This winter, gas prices have increased and are relatively high compared to most of the past 10 years, however they are still well below the prices we saw in 2022 and 2008.

As outlined above, higher natural gas prices forces natural gas power plants to increase their bids in the Ontario market. If these natural gas suppliers are called on to supply electricity, this then sets a higher marginal price for electricity as well. This still doesn’t fully explain the extreme price volatility we’ve seen in the past two months however.

Henry Hub Natural Gas Prices ($/MMBtu)

3. Generator Outages and Constrained Supply in Ontario

While rising demand and higher fuel costs provide the backdrop, the real story behind the price surge in the past two months is constrained supply.

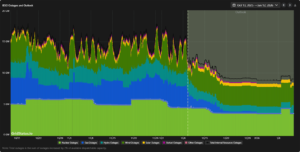

Over the past two months, Ontario has had several generators shut down for scheduled maintenance, specifically including nuclear units and high-efficiency combined-cycle natural gas units. When these lower-cost assets are offline, the grid is forced to lean on more expensive, less efficient generators to meet demand – exactly the kind of conditions that produce sharp increases in clearing prices.

This maintenance was scheduled for October/November because demand is usually low in Ontario during these months, but we have experienced a colder than usual start to the winter which is seeing higher demand than originally expected.

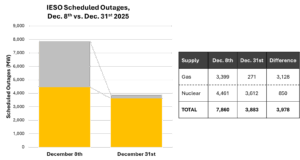

Thankfully, when comparing the scheduled outages for December 8th and December 31st, we can see that a significant portion of these facilities are expected to be coming back online in the coming weeks. Specifically, while we are still expecting 3,500MW of nuclear to be offline for refurbishment, nearly 4,000MW of supply is expected to come back online by the end of December.

IESO Historical and Projected Outages

What To Expect Moving Forward

As we head into January, we can expect natural gas prices to either stay the same or potentially increase slightly and for electricity demand to increase by another 1-3GW. Both of these will apply even more upward pressure on Ontario electricity prices.

However, we can also expect nearly 4GW of supply to turn back on after their scheduled maintenance is completed. This additional supply should relieve some of the system tightness that has contributed to the highest price spikes.

As nuclear and efficient gas units come back online the grid has more low-cost options available each hour, meaning it will have less reliance on inefficient peaking generators.

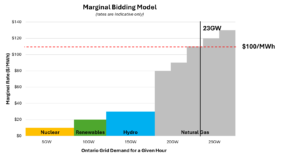

It’s impossible to know with certainty what this will mean for Ontario electricity prices in the near future, as this would require us to know the exact bidding strategies of every supplier in Ontario, however we can return to our simplified bidding model to understand the variables.

If we assume that Ontario demand will climb as high as 23GW in January, and that natural gas prices will increase slightly, then under a constrained supply mix this would require us to use all of the supply available to match demand with market clearing prices climbing to $130/MWh.

However, with 4GW of supply returning by the end of December, this will significantly alter the supply mix available in the Ontario market. In our simplified scenario, this would drop the market clearing price to $100/MWh despite the same increase in natural gas prices and significant increase in electricity demand.

The Bottom Line

Ontario’s recent surge in electricity prices came from a combination of higher demand, higher natural gas prices, and tighter supply from generator outages.

As more generation returns to service in the coming weeks, Ontario will enter January in a stronger supply position than the past two months. While we cannot predict Ontario electricity prices with certainty, the conditions that produced the most significant volatility are improving.

That means businesses should experience a more moderate and more stable pricing environment compared to the severe tightness seen through late fall.

If you’d like help understanding what these market conditions mean for your facility – or how to manage cost exposure during volatility – EnPowered is here to help.