In Ontario’s most recent Capacity Auction, clearing prices increased sharply in both the summer and winter obligation periods. The latest auction in December 2025 marked the highest prices seen since the program began, with the summer clearing at $645.24/MW-day, and winter clearing even higher at $725.31/MW-day – or a total of $169,063 per MW per year for Demand Response (DR) resources.

The Ontario grid is in need of additional capacity as demand continues to grow in the province, and we have seen that reflected in increased targets for the capacity auctions. From the 2022 to 2026 auctions there was an increase of 800MW (80%) in summer and 700MW (140%) in winter. This alone doesn’t explain the significant rise in prices that we saw in this latest auction however.

Prices in prior auctions had been rising, but gradually. Nothing in the historical trend suggested a move of this magnitude in a single year. To understand what happened, it is necessary to look beyond the clearing price and examine who showed up to supply capacity, who did not, and how those shifts changed the balance of supply and demand.

A Brief Look Back at Auction Pricing

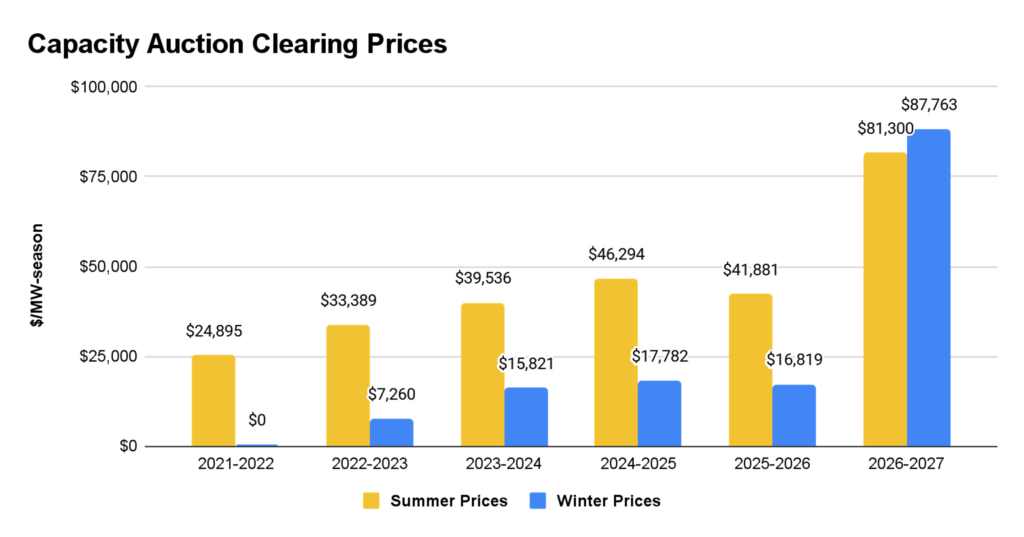

From 2021 through 2025, capacity clearing prices followed a relatively stable path. The value of 1MW of capacity during the summer season (May to October) increased from just under $25,000/MW-season in 2021 to over $40,000/MW-season by 2025. The value of 1MW during the winter season (November to April) also increased over time but remained well below summer levels, starting at $0 in 2021 and increasing to roughly $15,000/MW-season from 2023-2025.

The latest auction broke that pattern. Prices rose dramatically, especially winter prices which had historically lagged summer prices but now cleared above summer for the first time.

When prices move this quickly, it is usually a signal that something more fundamental has changed. In this case, that change was not on the demand side alone, but in how supply entered – or exited – the auction.

Who Supplied the Auction – and Who Didn’t

Generators: Choosing Certainty Over Auctions

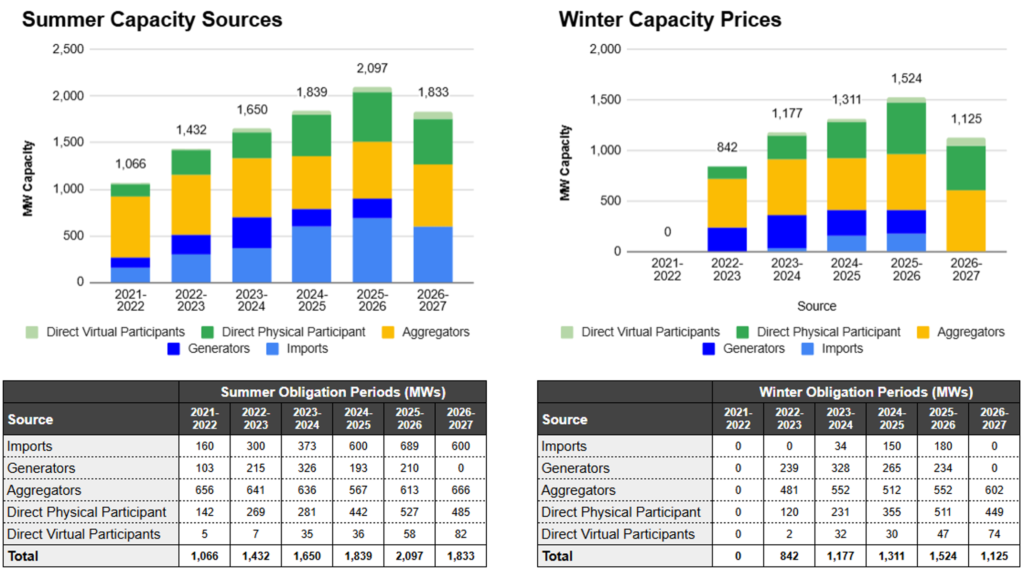

In earlier capacity auctions, generators played an important role by providing a meaningful block of 200-300MW of relatively predictable capacity. That supply applied downward pressure on clearing prices, particularly during winter obligation periods.

In the latest auction, generator participation disappeared entirely. The effect on the auction was immediate. With generator supply removed, the remaining participants were competing to fill a much smaller pool of available capacity, putting upward pressure on prices.

Imports: A Vanishing Source of Supply

Beginning in the 2023 auction Imports have provided significant supplemental supply in the capacity auction, though their participation has always been sensitive to external market conditions and limits on the amount of imports accepted into the auction. In the past few auctions, they’ve supplied roughly 600MW during the summer period and 150MW in the winter period. In the latest auction, however, a number of importers left the market. Summer import capacity declined slightly only because Hydro Quebec significantly increased its exports to Ontario to counteract the disappearance of other importers, however winter import participation disappeared entirely.

Regardless of the reasons, the outcome was straightforward: another source of flexible supply was no longer available. Combined with the loss of generator participation, this further tightened the market.

Aggregators and Direct Physical Participants: Holding Their Ground

While generators and imports pulled back, Demand Response aggregators (companies that aggregate the load of hundreds of smaller companies) and direct physical participants (large companies that directly opt-in their load to the auction) remained relatively consistent. Their participation fluctuated between obligation periods, but there was no broad withdrawal from the market.

This point is important. The price increase was not driven by aggregators reducing supply or exiting the auction. Instead, prices rose because other sources of supply declined while demand continued to grow.

Direct Virtual Participants: A Quiet but Important Shift

One of the more interesting changes in recent auctions has been the growth of direct virtual participation – companies choosing to directly participate in the capacity auction without having to be a physical market participant (which has additional regulatory burdens). Historically, this category represented a very small portion of the auction. In this latest auction, direct virtual participants accounted for a noticeably larger share of cleared capacity, particularly in the winter obligation period.

This reflects a growing number of customers choosing to participate directly rather than through an aggregator. Doing so requires confidence in forecasting, operational flexibility, and an understanding of program requirements. The increase suggests that more customers are engaging deeply with the mechanics of the capacity program.

At the same time, direct participation shifts risk onto the customer. As prices rise, the cost of underperformance or administrative error increases as well, making execution more important than ever.

Why Prices Rose So Sharply

When these participation changes are viewed together, the price outcome becomes easier to explain. Demand for capacity has continued to increase as system planners looked to secure more short-term capacity. At the same time, two historically important sources of supply – generators and imports – reduced or eliminated their participation in the auction.

With fewer megawatts available to meet higher demand, clearing prices rose to reflect the scarcity of dependable capacity. This was not a temporary distortion, but a market response to a changed supply mix.

Despite this significant increase in clearing prices, capacity secured through the capacity auction remains competitive. The Ontario IESO (the independent electricity system operator) recently completed a long-term procurement process which saw the cheapest supply, provided by energy storage resources, clearing at $672/MW-day. So, although clearing prices increased a lot this year, the secured capacity remains economic and tied to near-term system needs without longer term contractual commitments.

Execution Still Matters More Than Structure

Ontario’s Demand Response program is built around performance. Participants must forecast their ability to respond accurately, respond when called, and pass verification and testing requirements each obligation period.

EnPowered has passed every test to date. In a higher-priced environment, that track record matters. As clearing prices increase, the downside of missed performance grows as well, making reliable execution a central consideration for customers evaluating their options.

Over the past three years, EnPowered has grown steadily, doubling its customer base each year and becoming the fastest-growing Demand Response aggregator in Ontario. This growth has occurred alongside increasing market complexity and higher performance expectations.

Importantly, many customers have chosen to remain with EnPowered even as direct participation has become more common. In a market where prices – and penalties – are rising, customers are placing greater value on experience, execution, and the ability to consistently meet program requirements.

What This Means Going Forward

The latest auction results suggest that Ontario’s capacity market has moved into a new phase. Higher prices reflect higher value, but also a tighter and more selective supply environment.

The recent increase in clearing prices should be viewed less as a one-off event and more as a signal that the market has changed. Supply has shifted, demand has grown, and execution has become more valuable.

For customers participating in Ontario’s Demand Response program, understanding these dynamics – and choosing a strategy that aligns with their operational realities – will matter far more than chasing t he headline clearing price.