Ontario’s electricity market has changed dramatically over the past decade, and especially over the past year. Policies have shifted, pricing has become more volatile, and new market structures – such as the recently launched Day-Ahead market – have reshaped how value is created and captured. For businesses considering or already investing in backup power assets like generators or batteries, this raises an important question: Will these assets continue to deliver reliable returns in the future?

The short answer, based on more than a decade of data, is yes. But the long answer matters even more: batteries remain one of the most consistently valuable energy investments not because markets are stable, but because batteries themselves are flexible enough to thrive in unstable conditions.

And when backed by the right operational strategy, that flexibility becomes a long-term competitive advantage.

A Market That Appears Turbulent, Yet Produces Remarkably Consistent Value

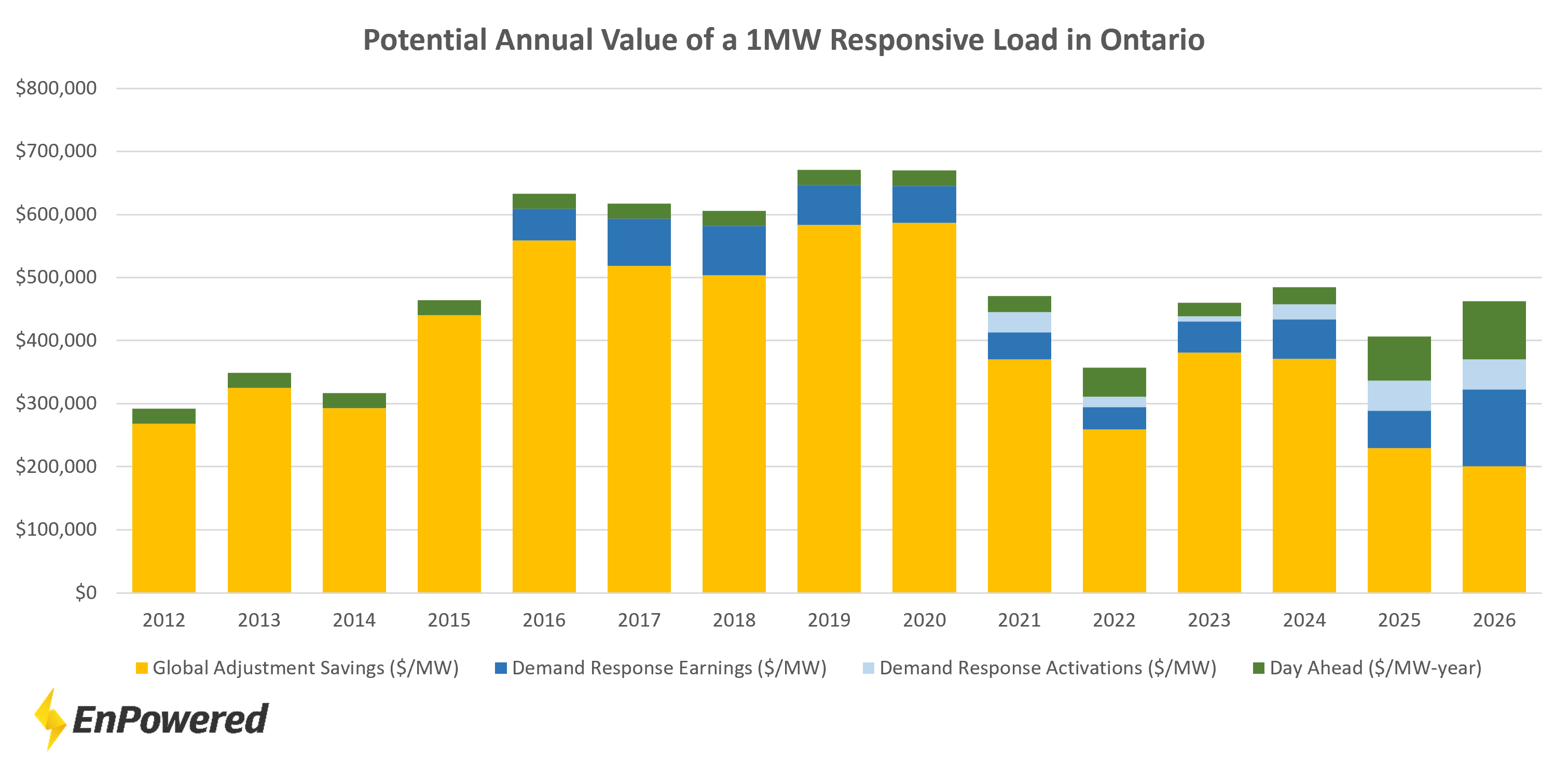

Ontario’s electricity programs look unpredictable when viewed individually. Global Adjustment savings surged in the late 2010s before contracting. Demand Response activations were practically non-existent for a decade, before becoming extremely common in the past year. And until recently, the commodity market offered only uncertain and risky arbitrage opportunities through real-time prices.

But starting in May 2026, Ontario introduced a Day-Ahead market, which created a more structured and predictable environment for price-based decision-making. Batteries now have clearer signals and more opportunities to respond when wholesale prices spike. Importantly, these Day-Ahead opportunities are incremental value layered on top of existing programs.

When you combine all these components, the long-term picture becomes clearer. Over the past 15 years, the total annual value of a well-controlled megawatt of storage has remained anchored around $400,000 per MW per year, even as individual programs expanded, contracted, or fundamentally changed.

This stability does not come from the market itself. It comes from the asset’s ability to adapt to changing market conditions.

The Flexibility of Batteries Is Their Superpower

Generators have long served as backup assets and have historically been the better economic decision, but their relative inflexibility is starting to limit their ability to unlock savings. They typically provide resiliency and, depending on configuration, may participate in major grid programs such as demand response (DR) or the industrial conservation initiative. However, their operating profile is rigid, they take more time to start, and they cannot economically cycle once or multiple times per day.

Batteries are different. They can respond instantly, discharge multiple times a day, and adapt to whatever opportunities the market presents. This is why even during periods of significant market change – whether global adjustment (GA) reform, evolving DR rules, or the introduction of the Day-Ahead market – the total value captured by a battery remains high. This became particularly relevant in 2025, when the value of responding to daily price signals in the Day-Ahead market increased significantly. Now, participating in the Day-Ahead markets can be worth nearly as much as participating in Demand Response.

A battery’s savings are not tied to one program. They come from every opportunity the market offers:

- Global Adjustment

- DR capacity payments

- DR activations

- Day-Ahead events

- Real-time price spikes

- Rate class alterations

- Backup value during outages

Because the system consistently rewards fast, flexible assets, batteries remain well-positioned regardless of how the market evolves. Flexibility is not just a feature – it is the foundation of long-term value.

Success Requires Active Management, Not Passive Operation

A decade ago, investing in a generator or battery was often perceived as a “set it and forget it” decision. Peak predictions were more predictable, DR events were rare, and the real-time market had almost no daily swings worth chasing. The asset largely followed a seasonal schedule and still performed adequately. Many customers felt that they could manage their assets manually and on their own.

That era is over.

Today’s market requires active, continuous, and highly informed operation. Batteries must be dispatched strategically – not just a few times per season, but often multiple times a week or even multiple times a day. Savings come from reading the market, forecasting conditions, understanding price formation, and making the right decision in the right five-minute interval.

Companies that rely on static operation, incomplete forecasting, or limited-program participation leave a substantial portion of their savings unrealized. The asset may be capable, but the controls are not.

EnPowered has invested heavily into bridging that gap. We have worked with our customers and spent years designing systems, forecasts, and control strategies that allow batteries to participate fully across every program, every event, and every price trigger. This is the difference between capturing the theoretical full-stack value and achieving it consistently in real operations.

New Opportunities Are Emerging, such as Utility-Led DR Programs

Another important development is happening quietly but significantly across Ontario. Local utilities are beginning to introduce their own Distribution-Level Demand Response programs, separate from the provincial IESO-administered DR programs. These offer customers new incentives to reduce load or discharge behind-the-meter assets during local system constraints.

This is a major step forward for battery economics. Distribution-level DR programs effectively create a new layer of value – one that batteries are particularly well-suited to capture due to their speed, controllability, and reliability.

As more utilities implement these programs, batteries will have access to additional earnings streams that generators may not qualify for. This adds yet another reason why the future value of storage assets remains strong even as the broader energy landscape continues evolving.

What This Means for Organizations Evaluating Storage or Backup Power Solutions

If your organization is exploring the business case for a new battery or generator, the message is straightforward: the market will continue to change, but the value of flexibility will not. Batteries deliver flexibility better than any other asset, and that flexibility is exactly what the Ontario grid rewards.

If you already own a battery or generator, the question becomes whether you are unlocking every available opportunity. With the right controls, existing assets can perform far better than many companies realize. With passive or limited operation, even the best hardware will underperform.

In a market defined by change, strategy – not hardware – is what drives long-term results.

Considering a Battery? Already Have One? Let’s Talk.

Whether you’re evaluating an investment or looking to improve the performance of an existing asset, EnPowered can help you understand the full stacked value, model your expected ROI, and manage your system to participate in every relevant opportunity. The historical data is clear: storage assets offer stable, meaningful returns when operated strategically, and those returns are poised to grow as new programs emerge.

If you want to explore what this could look like for your organization, we’re here to help.