Flexible Assets Capture More Value in Ontario’s Changing Electricity Market

Ontario’s electricity market continues to evolve, and the past year has exposed just how valuable flexibility has become for customers. In an earlier article, we showed that even as market rates change, Demand Response activations have shifted, and the Day-Ahead market has launched, the stacked value of flexible assets still averages close to $400,000 per MW-year. The fundamentals remain strong, but the methods of participation are changing.

Today, customers can no longer rely on a few annual peaks or a once-a-season activation to drive their savings. Instead, value increasingly appears in the hourly price signals and daily spreads that shape Ontario’s new market reality. And the way each customer participates depends heavily on the type of assets they operate.

Below, we break down three common asset types – generators, batteries, and BAS-driven facilities – and illustrate how each can capture meaningful value through smart, threshold-based participation. Our analyses assume a 1MW load and covers the last 9 months (May 2025 to January 2026), as that is the period since Ontario’s IESO introduced major changes through their Market Renewal Program.

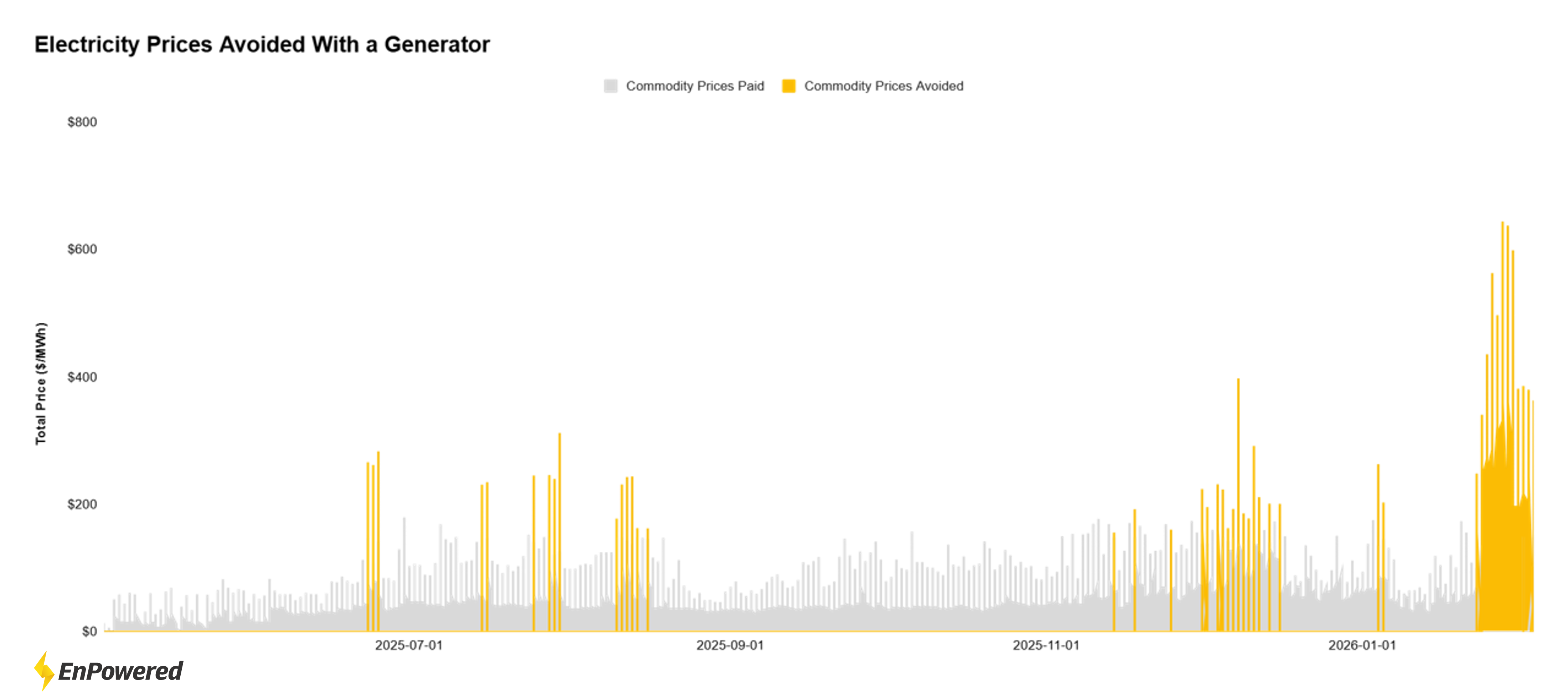

1. Generator and CHP Customers: Run When Prices Exceed Production Costs

For businesses with generators, particularly those operating Combined Heat and Power (CHP) units, the most effective strategy is to link generator runtime directly to electricity prices rather than fixed schedules. Most CHP units have a well-understood cost of production – often around $80/MWh when fuel and maintenance are included, although this can vary between $70-$100/MWh depending on generator efficiency and fuel costs. When grid prices rise above this cost, it becomes economically advantageous to run.

A practical approach is to set a price threshold of $150/MWh, allowing the generator to start whenever the market exceeds that level and continue running for as long as conditions justify it. In our analysis, we constrain each response to a minimum of three hours and a maximum of twenty-four hours to reflect realistic operational preferences and warm-up requirements.

Using these parameters, generators would have been called into service over 70 unique days over the analysis period, operating a cumulative 491 hours. During these hours, avoiding grid electricity would have saved $126,339 in electricity costs. Fuel and operating expenses for the same period totaled $39,280, resulting in net savings of $87,059 per MW. If we extend this to a full year of savings, instead of the 9 months in this analysis, that would equate to net savings of $116,079 per MW per year.

This example illustrates how even a simple, rule-based dispatch strategy – run when electricity exceeds your production cost – can produce strong, repeatable results in today’s volatile price environment.

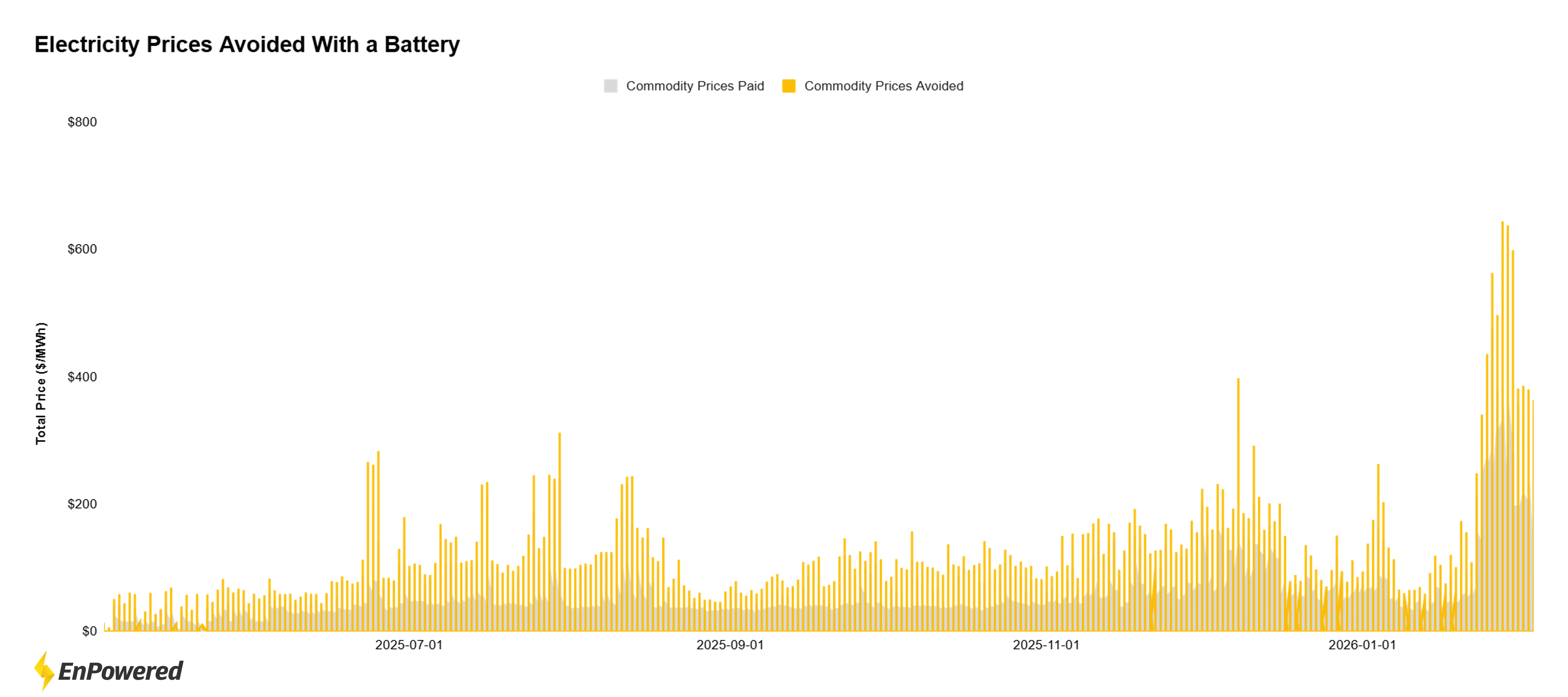

2. BESS Customers: Daily Arbitrage Within Warranty Limits

Battery systems participate in the market differently. Their advantage comes not from avoiding high-priced hours occasionally, but from cycling regularly to exploit the spread between low and high prices. With the launch of the Day-Ahead market, these spreads have become more predictable and actionable, giving batteries new opportunities nearly every day of the year.

A typical operational framework is to allow the battery to charge overnight during the cheapest hours and discharge during the most expensive hours of the day. To remain within battery capacity limitations and warranty constraints, the asset in our analysis can respond for up to four hours per day.

Using these parameters, and assuming a marginal degradation and charging cost of $47/MWh, a 1 MW battery would have responded every day where the price spread was large (277 days in the analysis period), cycling across 1,107hours in total. These operations would have produced $129,146 in electricity savings through daily arbitrage. After accounting for $52,571 in charging costs, the system would have achieved net savings of $76,575 per MW. If we extend this to a full year of savings, instead of the 9 months in this analysis, that would equate to net savings of $102,100 per MW per year.

Importantly, this value is independent of GA or DR programs – meaning batteries continue to create strong returns even before layered program participation is added.

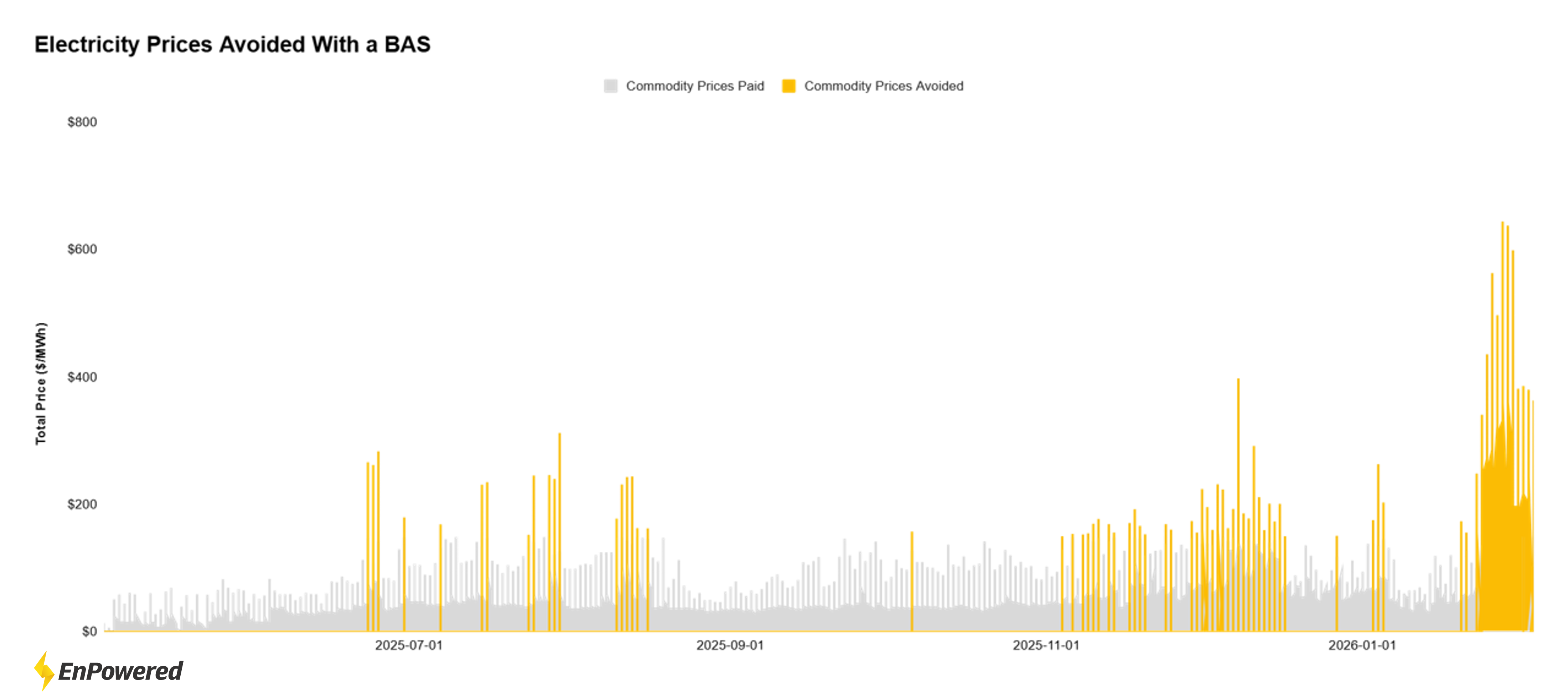

3. BAS Customers: Shift Load When Prices Rise

Building Automation System (BAS) driven facilities – campuses, hospitals, and industrial sites – typically rely on electric boilers, chillers, HVAC loads, and other flexible systems that can shift or shed load without disrupting operations. As electricity prices have become more volatile, these businesses can increasingly benefit from fuel switching or load shifting strategies.

A common and highly effective approach is to shift boiler load from electricity to natural gas when electricity prices exceed a site-specific breakeven point. In our scenario, we assume customers switch whenever prices rise above $150/MWh, reflecting the cost of operating a natural-gas boiler at approximately $70/MWh equivalent input cost – although this would vary for each asset. Unlike generators or batteries, boilers can often shift instantly and for long durations, so we allow a maximum response of twenty-four hours and no minimum response duration.

Using these parameters, a 1 MW boiler would have shifted load over 70 unique days over the analysis period, covering 522 hours in total. Avoiding grid purchases during these hours would have saved $131,368 in electricity costs. The cost of producing the same thermal output using natural gas totaled $36,540, yielding net savings of $94,828 per MW. If we extend this to a full year of savings, instead of the 9 months in this analysis, that would equate to net savings of $126,437 per MW per year.

For many BAS customers, this strategy requires no new hardware – only a willingness to operate differently in response to market conditions.

Across All Customer Types, Flexibility Now Drives the Majority of Value

Although generators, batteries, and BAS facilities participate differently, a unifying theme emerges: flexibility is becoming the most important determinant of value in Ontario’s electricity market.

- Generators earn more by linking runtime to price thresholds rather than fixed schedules.

- Batteries achieve daily savings through consistent arbitrage, not just seasonal peaks.

- BAS customers unlock substantial value through real-time fuel switching and load shifting.

Across all three groups, the customers who succeed are those who treat flexibility as an operational capability and not an afterthought. Hourly participation – once optional – is becoming essential.

Ready to Capture More Value With Your Asset?

Whether you operate a CHP system, a battery, or a BAS-controlled facility, your success in the modern market depends on using your assets more intelligently and more flexibly. EnPowered helps customers automate these strategies, apply optimized thresholds, and participate across all available programs with minimal manual effort.

If you’d like help evaluating your asset’s potential, modeling your thresholds, or implementing automated controls, our team is ready to assist.