Financing for your energy equipment

Large Funder Network

We find the optimal financing provider for your needs

Smart Financing Structures

We build financing structures that maximize clean energy rebates and tax credits

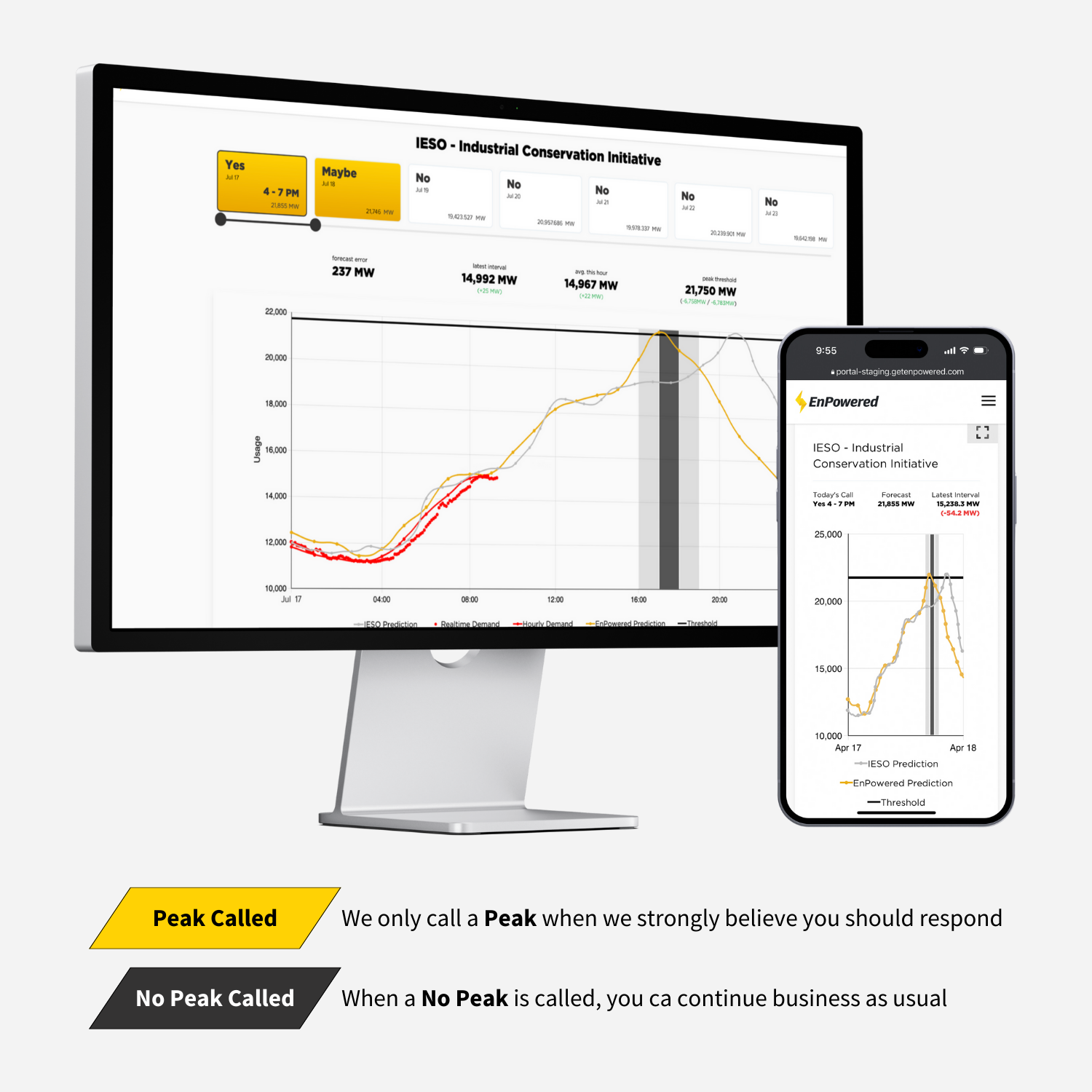

Energy Program Participation

We enable you to earn revenue with your new energy asset

Competitive financing options built for your equipment needs

Our large network of private funders helps find the optimal financing solution for your needs.

Specializing in energy equipment, our funders provide asset-backed financing that leverages the installed asset as collateral, eliminating risks to existing business assets.

Unlock clean energy incentives and rebates

Our team builds financing structures that maximize clean energy rebates and tax credits to offset equipment costs.

Taking all financial levers into account, we ensure the most favorable terms for your business.

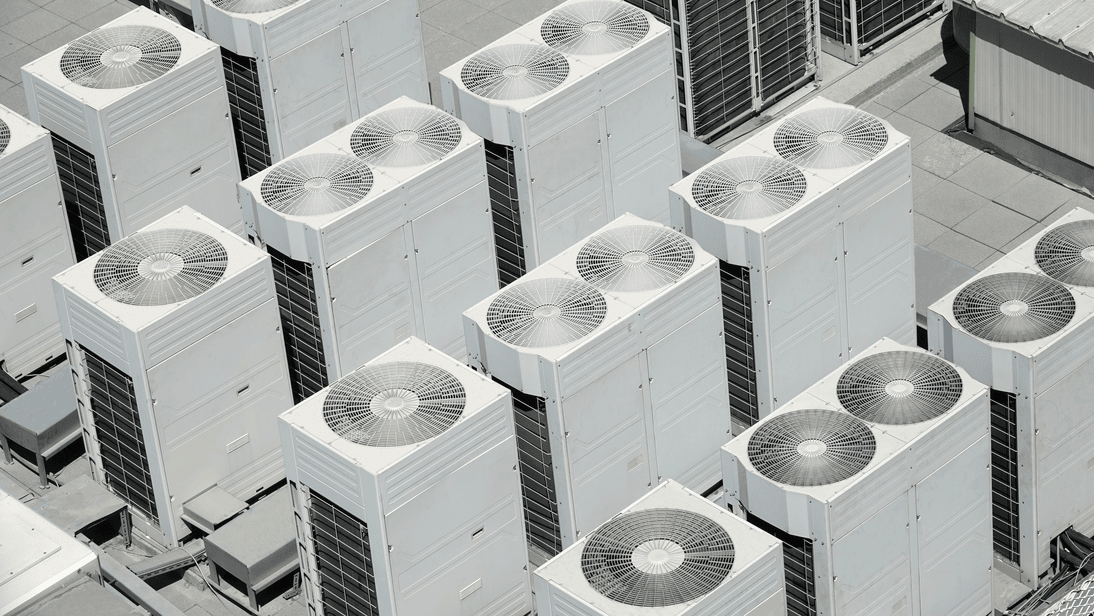

Earn money through flexible energy assets

Combining our expertise in demand response and coincident peak programs with flexible energy assets helps earn revenue with minimal business disruption.

Whether it’s batteries, generators, heat pumps, HVAC, BAS, or other energy assets, we’ll find the best financial advantage for your business.