Every business wants to adopt clean technologies and save on their energy bills but they often find themselves blocked by a lack of funding sources and competing operational priorities. Embracing clean energy technologies, such as LED lighting and solar panels, can significantly reduce energy costs and environmental impact but, for many commercial, industrial, and institutional (CI&I) businesses, finding the capital necessary to fund these projects is an insurmountable problem.

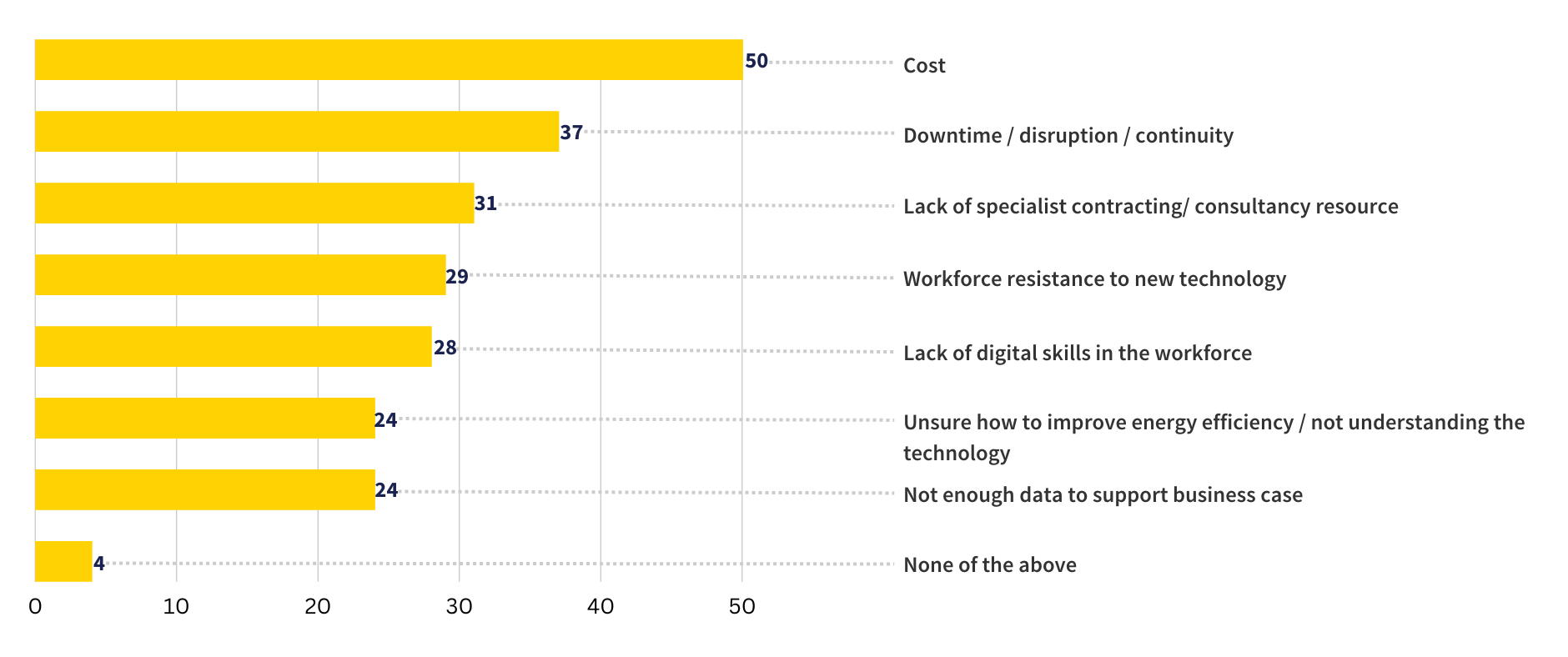

According to the ABB Energy Efficiency Investment Survey, cost is the biggest barrier to improving energy efficiency for companies in many industries around the world. In their desire to become more sustainable, businesses face the challenge of reallocating financial resources among competing operational priorities and are constrained by the lack of government support and barriers put up by traditional financial institutions. While residential solar energy installations tend to be well-funded, for example, commercial deployments lag far behind.

The biggest barriers to improving energy efficiency (Source: ABB)

EnPowered saw businesses saying “no” to energy solutions and energy efficiency upgrades due to the perception that they couldn’t afford them. Finding ways to apply energy savings to projects became EnPowered’s mission, and CI&I businesses now have a viable option to cover the capital expenses of implementing clean energy technologies with zero upfront cost and without sacrificing other business priorities.

How “Pay with Your Savings” works

Businesses that want to finance energy solutions and energy efficiency upgrades often find themselves stuck in a holding pattern:

- The existing capital budget has an allowance for facility or equipment upgrades but it is insufficient for major sustainability upgrades. Consider that the average cost for a modest 200 kW commercial solar installation is over $332,000 US (based on an average PV system price of $1.66 US) – it adds up quickly.

- To bridge the gap, businesses seek financing through a bank or other traditional lender, where the options are often limited by terms that don’t match the project (e.g., four-year financing for a planned 15-year sustainability upgrade).

- The number of remaining lenders that can match the value and terms of the project are very small, and not available in every region. In essence, there isn’t enough financing supply to satisfy the unique demands of commercial sustainability projects.

- The business decides to implement a much smaller project, with limited benefits, and hopes to try again next year.

EnPowered breaks this cycle by finding and aggregating different funders and funding options to help businesses choose the financing solution best suited to their terms. As there is no single funder in the world that can finance every project, EnPowered’s large portfolio of clean energy players works collectively to ensure projects are financed and sustainable for the long-term health of the business.

-

“An important upside to investing is that saving energy means saving money. Depending on the application, investments can have a quick payback time of 6 to 24 months while delivering long-term benefits for the environment.”

– ABB Energy Efficiency Investment Survey

This unique approach empowers CI&I businesses to adopt energy solutions and energy efficiency upgrades without the burden of upfront costs that strain capital and operational budgets. It also allows them to redirect their capital towards other strategic investments and business priorities with minimal risk, as the sustainability project essentially pays for itself.

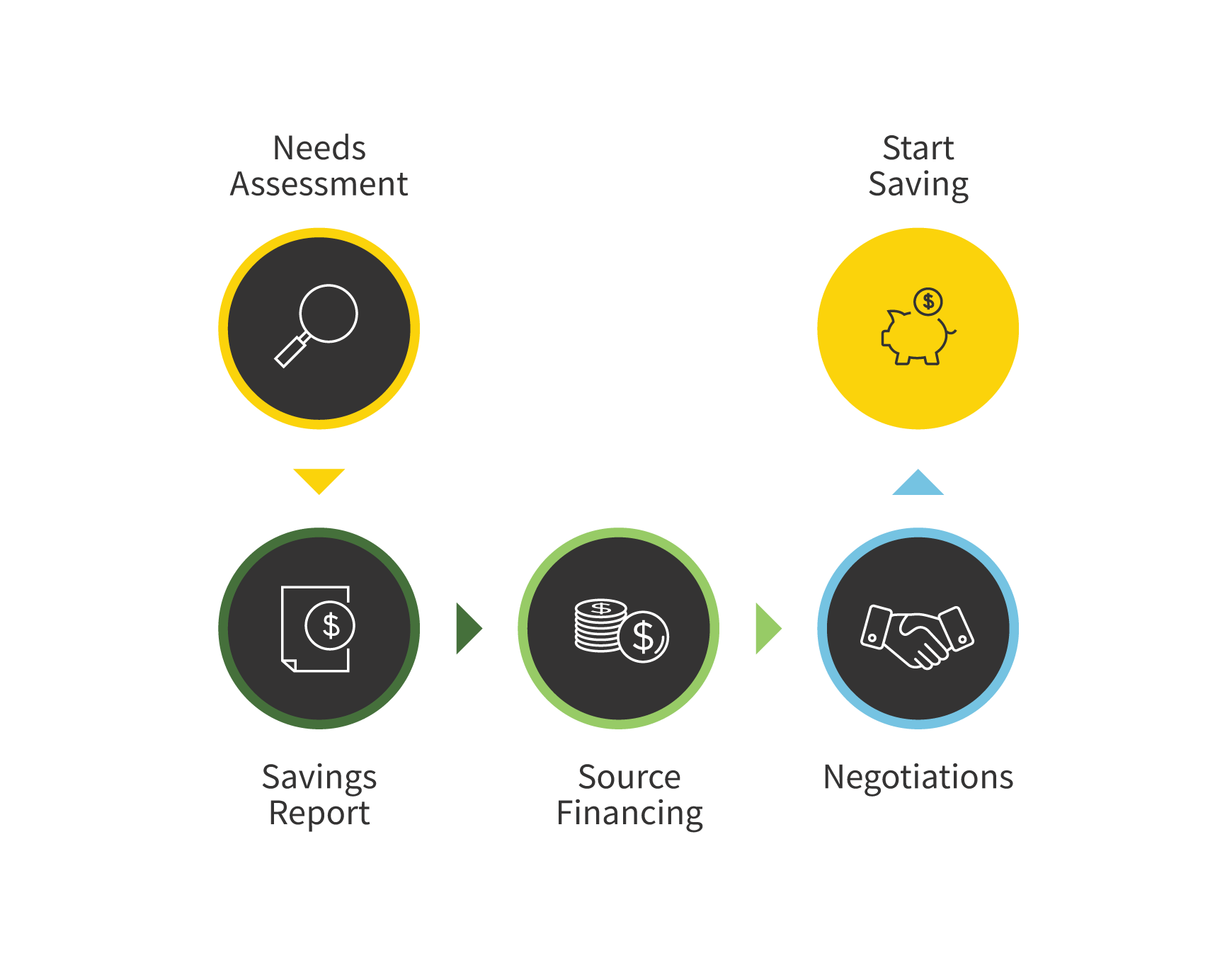

How EnPowered’s financing platform works

3 examples of “Pay with Your Savings” projects

The “Pay with Your Savings” approach taps into the hidden budget available in any CI&I business. Here are three examples of sustainability upgrades that can be funded by repaying investments through reduced energy costs.

1. LED lighting

The switch to LED lighting is compelling for businesses looking to optimize energy efficiency, and is often the first technology they look at to control energy costs. LEDs consume significantly less energy than conventional lighting sources, resulting in less money spent on electricity bills and related costs. LED technology also has a longer lifespan and requires less maintenance effort, leading to more operational savings over time.

The “Pay with Your Savings” financing model lets businesses use the money currently spent on energy-wasteful lighting to pay for new lights on day one of the installation. On average, this takes about five years to pay off, all while improving the sustainability practices of the business.

2. Solar projects

The potential for significant energy savings and environmental benefits through solar power is undeniable, as is the reduction in dependence on traditional energy sources. By generating their own renewable energy on-site, businesses can significantly reduce their reliance on and costs of utility-provided electricity.

Many businesses find themselves blocked by the large upfront costs and long-term payback time frame of solar arrays. EnPowered eliminates these concerns by allowing them to pay with the savings earned from the project immediately, kickstarting their clean energy journey with little financial risk.

3. On-site battery storage

The integration of battery technology into a business’ energy infrastructure enhances resilience and reduces electricity costs. On-site battery storage systems help optimize energy usage, reduce reliance on the grid, and ensure a stable and consistent power supply.

Batteries also open the possibility of participating in coincident peak demand reduction programs, where businesses contribute to grid stability by reducing their electricity consumption during peak periods. By drawing battery energy instead of relying solely on the grid, organizations can lower their electricity demand at critical times and avoid costly peak demand charges.

Through the “Pay with Your Savings” model, new battery installations pay for themselves over time and businesses don’t have to worry about taking capital away from their other operational needs and projects.

EnPowered’s growth to date

How platforms facilitate “Pay with Your Savings” solutions

The strong demand for energy solutions and energy efficiency upgrades hasn’t made it any easier to navigate the complex landscape and mechanisms of project financing. Aligning a business’ unique needs with the fragmented distribution of clean energy contractors, funders, and energy retailers is like turning on a light bulb in the dark – you must know what to look for and where.

EnPowered collaborates with a large portfolio of clean energy players to provide flexible financing options tailored to individual energy-efficiency goals. These platforms help navigate the complexities of financing mechanisms, ensuring seamless implementation and facilitating accelerated savings. Supported by this network, businesses benefit from the expertise and guidance of industry professionals who understand the intricacies of energy-efficiency goals and can identify the most suitable financing option, whether through loans, leases, Purchase Power Agreements (PPA), or Energy Service Agreements (ESA), that tailored to their specific project requirements and financial capabilities.

Faster and simpler project financing

The beauty of the “Pay with Your Savings” approach lies in its ability to transform a perceived financial obstacle into an opportunity for businesses to adopt sustainable practices. This model leads to no upfront costs and net savings from day one as the energy savings accumulate.

This net positive financial outcome results in a big win for CI&I businesses, unleashing their potential to become trailblazers in sustainable practices. Adopting “Pay with Your Savings” now not only gets businesses to energy savings and environmental stewardship faster, but it also positions them as leaders in their respective industries to inspire others to follow suit.