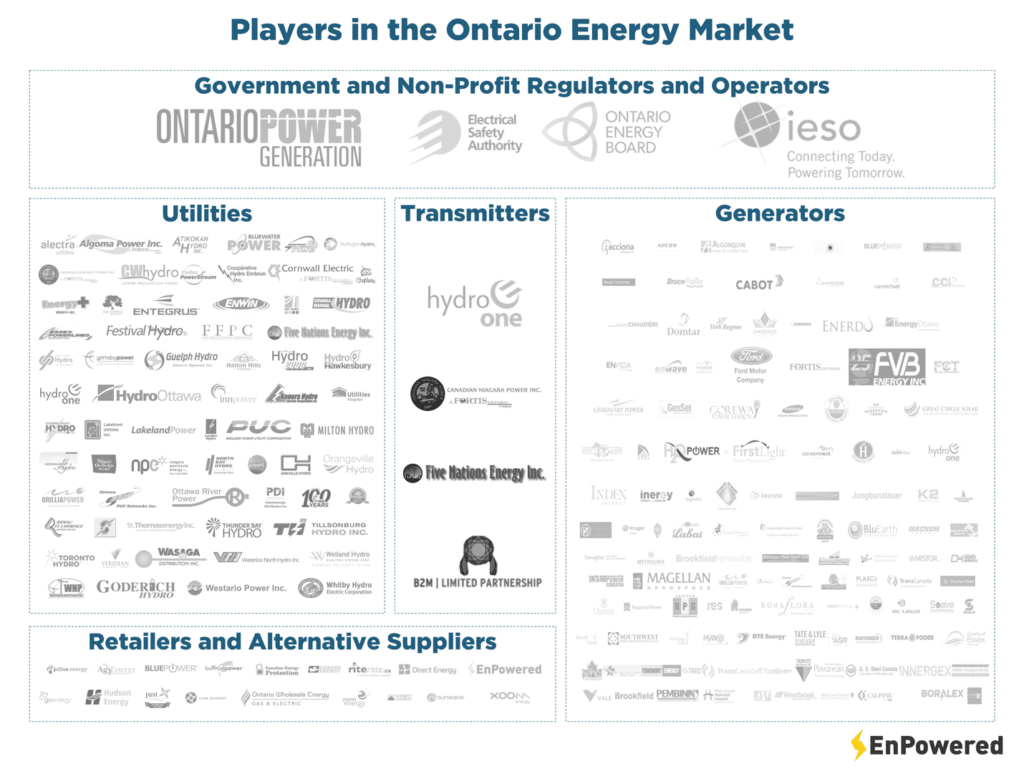

The Ontario electricity market is a complex system with many diverse players. Below follows an explanation of each of these key player types, outlining their role in the Ontario electricity market.

In this five-part series called “Tame the Beast,” the goal is to help you understand:

- Part One: The Different Players in the Ontario Electricity Market

- Part Two: What Happened to Ontario’s Electricity Price

- Part Three: The Impact of Electricity Peaks and What is Global Adjustment

- Part Four: Companies are Trying to Reduce Electricity Costs

- Part Five: How Companies are Reducing Global Adjustment Costs

To begin the series, this section explains the types of players in the energy market. The Ontario electricity market is a vast and complex system involving many diverse players, both public and private.

The market has gone through many changes over the past 100 years, but as it currently stands, it can be divided into a few groups of key players. Below follows an explanation of each of these key player types, outlining their role in the Ontario electricity market.

- Generators;

- Transmitters;

- Electricity Distributors;

- Alternative Suppliers;

- Electricity Consumers;

- The Independent Electricity System Operator (IESO);

- The Ontario Energy Board (OEB);

- The Ontario Power Authority (OPA);

- The Ontario Power Generation (OPG); and

- The Electrical Safety Authority (ESA).

Generators

Generators produce electricity within the Province of Ontario. They include companies ranging from large nuclear power generators, like Bruce Power, to an individual homeowner with solar panels on their rooftop. To this day, the majority of the electricity in Ontario is produced by nuclear and hydroelectric generation facilities.

In the Province of Ontario, there are 3 nuclear power plants generating 57% of our electricity needs, and about 130 hydroelectric dams generating a further 22% of our electricity needs. It is only the remaining quarter of Ontario’s electricity supply which has changed significantly in the past 20 years and has attracted a significant amount of public attention over the past few decades.

This became especially true in recent years after the contentious decisions to retrofit and then later shut down the coal power plants in Ontario.

Those decisions have been critiqued extensively by various research and educational organizations which called into question the environmental benefits of these decisions, especially when compared to the economic impacts they have been attributed to.i

| From getting your project funded to finding savings once commissioned, contact us to ease the financial impact of your clean energy transition. Let's talk clean energy solutions. |

Recently, criticisms have increased in volume following the shut-down of two natural gas power plants. That decision cost taxpayers $1.1 billion and a recent court ruling has found Dalton McGuinty’s Chief of Staff guilty of deleting evidence in relation to the case.

According to the former Provincial Conservative Leader, “it’s a sad day when a premier’s most senior official is found guilty of trying to orchestrate a cover-up of the $1.1 billion gas plant scandal.”ii

With the attention of the public focused on these scandals for the past 10 years, it seems that the public has completely ignored a far more ominous statement made in 2009 after the passing of the Green Energy Act (GEA).

One of the outcomes of that act was the indication that over the next 20 years approximately 80% of the Province’s electricity generation capacity will need to be replaced.iii

Given the enormous investments and the substantial resulting increase in electricity costs that was needed to replace only 20% of Ontario’s generation supply, it would seem that Ontario is likely to face far greater price increases when the remaining 80% is replaced in the near future.

It is notable to point out that although the energy market is ostensibly deregulated and should therefore have private corporations competing to supply the Province’s electricity, the vast majority of electricity generated in the Province of Ontario is not in fact generated by independent private corporations, but rather by a sole key player.

Ontario’s Energy Board (OEB) has issued just over 100 generating licenses, but roughly 70% of the electricity generated is produced by a single entity called Ontario Power Generation, also known as OPG, which will be described in more detail later in this article.iv

Of the remaining 30% of electricity generated in Ontario by organizations that are not the OPG, nearly all of it comes from a single power plant called the Bruce Nuclear Generating Station. This plant was built between 1970 and 1987 by a provincial Crown corporation, and precursor to OPG, called Ontario Hydro.

The cost of this facility was originally estimated to be $4.8B, but eventually the total cost of the project rose to a total of $7.8B. This is still a better record than the cost overruns experienced during the construction of the Pickering B and Darlington nuclear facilities, which saw a cost over-run of 350%.

Although nuclear is a relatively clean and reliable form of electricity when compared to other energy sources, nuclear power plants remain some of the most expensive energy generation facility types to build.

To compare, the cost of construction of a nuclear power plant ranges between $5,500/kW and $8,100/kWv, whereas the cost of the construction of a conventional combined cycle plant is just $614/kW, a difference of up to 13 magnitudes.vi

Typically, the cost to build such a facility would need to be paid back over the many decades that the facility would be expected to generate electricity.

This would usually be done by including the cost of the asset in the electricity produced by the power plant. This was not done in this case, however, and instead the cost of this debt was added to the bills of Ontario consumers as part of the notorious Debt Retirement Charge.

In the summer of 2000, just after the restructuring of Ontario Hydro, the Bruce plant was leased out to a private operator called Bruce Power. While Bruce Power has done a good job of managing this facility and producing safe, reliable electricity for the Province of Ontario, it is notable that the private citizens of the Province of Ontario were still paying back the debts incurred for the construction of this facility in 2018.

Over 18 years since this agreement was created, the Debt Retirement Charge remained on the bills of many businesses in the Province of Ontario.

Transmitters

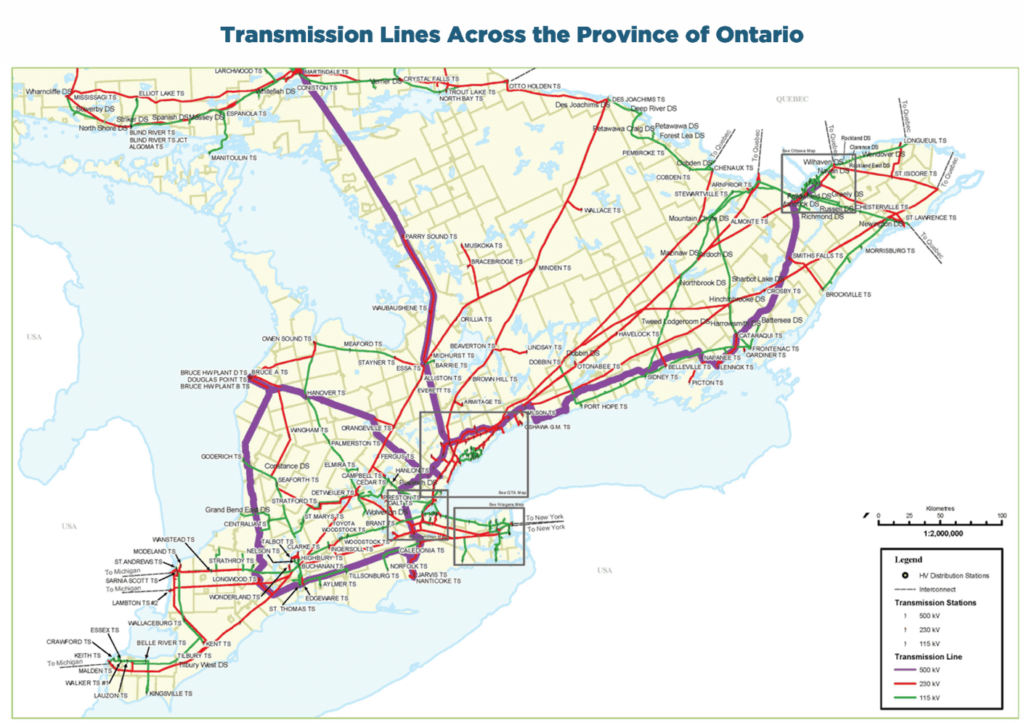

Transmitters are responsible for the transmission of electricity over very long distances from the various generating facilities to the areas where electricity is consumed. Many generating facilities are located in very remote regions, far from where the electricity is ultimately used – particularly so in the case of the hydroelectric facilities that are scattered throughout the Province.

A large portion of Ontario’s 37GW of generation capacity is located in the remote northern parts of the Province.

The transmission lines from these facilities are mostly owned and operated by Hydro One, which is also a successor of Ontario Hydro.

Hydro One’s network of transmission lines was analyzed by the Auditor General of Ontario in 2015, and the resulting report stated that Hydro One’s equipment was aging and “at [a] very high risk of failing,” the cost of necessary repairs was calculated to be over $4 billion. These upgrade costs, in turn, directly increased delivery costs in electricity bills.vii

Distributors

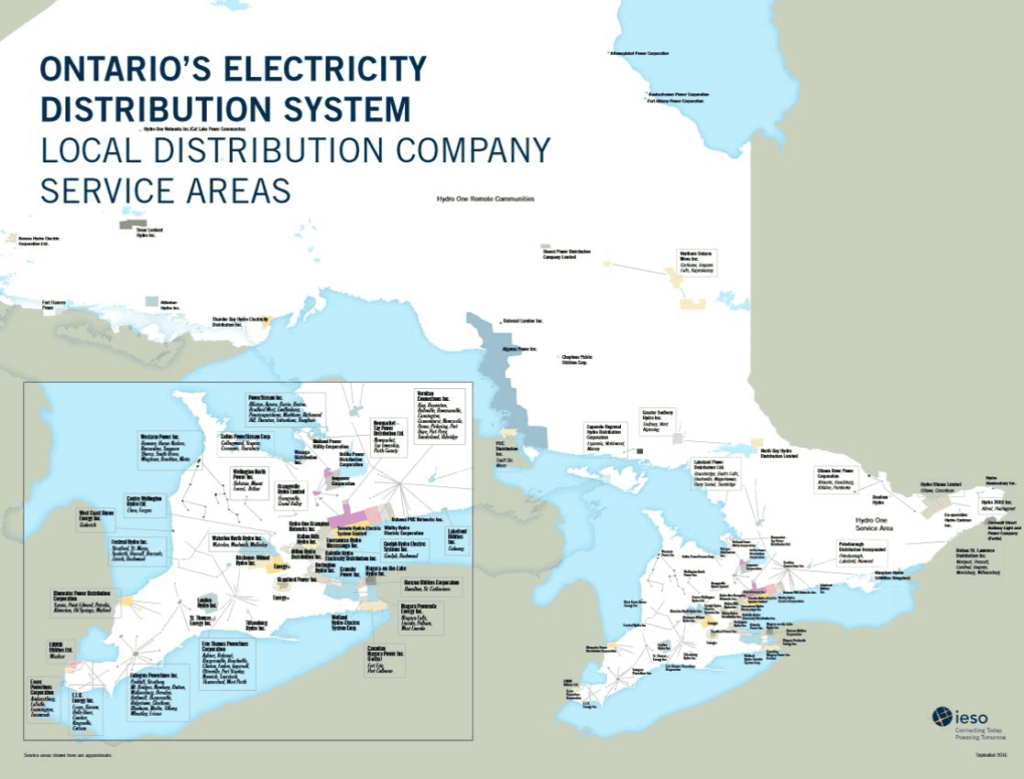

Distributors are responsible for carrying electrical power from Hydro One’s high-voltage transmission lines to local homes and businesses in a given area. In many parts of the province, Hydro One also acts as a distributor in areas which are not covered by private Local Distribution Companies (also known as LDCs, utilities, Local Distribution Utilities, or LDUs).

This is a responsibility it inherited from the historical role of Ontario Hydro. Aside from Hydro One, there are around 70 local electrical utilities in Ontario serving regions as small as an individual community of 1,900, in the case of the Saskatchewan Power Corporation, or as large as most of Toronto serving 800,000 people, in the case of Toronto Hydro.viii

The utilities in Ontario, a mixture of private and public organizations, are faced with many challenges.

These include the obligation to maintain a reliable electrical grid while experiencing shrinking revenues due to continued reductions in electricity usage by customers, increasingly frequent extreme weather events, ongoing significant investments in physical assets, as well as necessary investments to prepare for new technologies.

Of the many distribution companies, Hydro One is by far the largest by land area serviced as it is responsible for supplying many of Ontario’s remote and rural communities with electricity.

Largely due to the important role that it plays in the Ontario electricity grid, Hydro One has remained a public Crown Corporation for many decades even while the rest of the energy sector was privatized. In 2015, however, the Premier of Ontario decided to privatize Hydro One in a move that many critics have stated will lead to increased electricity costs for Ontarians.

This decision has been widely criticized as short-sighted by numerous parties, including the financial accountability officer for Ontario, which stated that the decision may lead to short-term benefits but at the significant price of increased long-term costs.ix

Moving forward, Hydro One will be faced with increasing challenges due to its aging infrastructure, which will result in consumers of electricity likely facing even further increases in electricity costs.x

Lastly, distributors are also expected to be the primary provider of electricity to consumers that have not chosen an independent electricity supplier.

In this role, distributors operate as the default supplier, thereby acting as the billing agent for most customers including those customers that sign-up with alternative suppliers, providing customer service and support, and finally implementing conservation measures in order to attempt to offset the rapidly increasing energy costs in the Province of Ontario.

Unlike some other jurisdictions in North America, utilities in the Province of Ontario currently serve nearly all energy consumers.

Alternative Suppliers

Alternative suppliers of electricity, also known as deregulated energy providers or retailers, serve electricity consumers in deregulated jurisdictions, and provide both residential and enterprise consumers with alternative ways to acquire electricity. These players are not typically involved in the provisioning and delivery of electricity, but rather act as financial intermediary parties.

This means that they allow consumers more choice in how they pay for their electricity; however, the electricity that a consumer receives is always the same in a given area, whether or not they sign a contract with a deregulated energy provider.

Even though the Province of Ontario is deregulated, the majority of electricity users still opt to receive their electricity from their default supplier, aka their utility. This is not for lack of trying by the retailers of electricity to attract new customers. As many Ontarians will likely recall, in the 2000s energy retailers in the Province had aggressive door-to-door sales teams.

Many consumers complained about misleading sales practices to the provincial regulators, which even led to several large energy retailers being banned from the Province.xi

The electricity that a consumer receives is always the same in a given area, whether or not they sign a contract with a deregulated energy provider.

The Ontario Energy Board (OEB), described in more detail below, allows consumers to file complaints about energy companies and publishes this information publicly here.xii Amongst these companies, there is a range of consumer complaint levels, with Sunwave Gas & Power leading the list in 2015 with 430 complaints per 1000 contracts.

Another example of the controversies marring this sector was the Just Energy case as reported by Global News, wherein the company was heavily criticized for its sales practices.xiii

The unscrupulous business practices of various deregulated energy retailers were so infamous that the Province passed legislation that prohibited door-to-door energy marketing altogether in January of 2017.xiv

Consumers

The users of electricity are referred to as consumers, and they vary in size from residential customers through to large manufacturing plants. They can opt to either purchase their electricity directly from their default supplier or from a retailer operating in their local market. In other markets, consumers can theoretically find significant savings by working with retailers.

With that said, at present in early 2019, EnPowered recommends that all Ontario consumers of electricity, large and small, stay with their default utility energy supplier.

Despite the fact that there are a number of companies that continue to sell fixed-rate electricity contracts in Ontario, “these plans and all other plans we have seen are unable to help any of our customers save money on their electricity bills.”xv

For the largest of businesses, there are more options available – such as purchasing electricity directly in the real-time energy marketxvi which implies entering into arrangements either directly with generators or through retailers as intermediaries. When doing these sorts of deals, it is important to manage the risk resulting from the price fluctuations in the electricity market.

At the same time, it is these very fluctuations that enable companies to potentially unlock huge savings by managing their hedges and options in a pragmatic fashion.

The Independent Electricity System Operator (IESO)

The Independent Electricity System Operator (IESO) is the corporation responsible for operating the electricity market in the Province of Ontario.

The IESO is one of the seven Independent System Operators (ISOs) in North America along with the California Independent System Operator (CAISO), the New York Independent System Operator (NYISO), the Electric Reliability Council of Texas (ERCOT), the Midcontinent Independent System Operator (MISO), the Independent System Operator New England (ISO-NE), and the Alberta Electric System Operator (AESO).

There was an eighth called the New Brunswick System Operator (NBSO) responsible for operations in the Province of New Brunswick, but this system operator ceased operations when New Brunswick’s electricity policy was changed by its government.

Aside from the aforementioned ISOs, there are also Regional Transmission Organizations that function similarly in that they are independent operators responsible for a particular region with operational authority within it.

There are two RTOs in North America including PJM Interconnection (Pennsylvania-Jersey-Maryland) and Southwest Power Pool (also referred to as the SPP).

In general, the IESO is accountable for ensuring adequate supply planning occurs to meet Ontario’s electricity needs. In the performance of this function, the IESO collaborates with key stakeholders to ensure that the Province’s energy needs are being met both today and in the future.

The IESO also works as a regulator and a director of action for energy initiatives, coordinating efforts of transmitters and distributors, as well as regional communities, to ensure consistent delivery of electrical service and sustainability of the grid. The IESO is an independent, non-profit entity with a board composed of directors appointed by the Government of Ontario.

In addition to the aforementioned tasks, the IESO operates a virtual marketplace that allows members to buy and trade electricity. Moreover, it manages forecasting of provincial energy demand and thus functions as a system controller for the provincial electricity grid.

The Market Clearing Price, as well as the Day Ahead Clearing Price, is managed and set by the IESO; these being two key electricity markets for wholesale electricity management located within the Province of Ontario.

Ontario Energy Board (OEB)

The Ontario Energy Board (OEB) is a regulator for natural gas and electrical utilities and other market players. Its chief tasks are setting the rates for both natural gas and electricity, and issuing licenses to all participants in the electricity sector.

These include the IESO, generators, transmitters, distributors, and retailers for the electricity market, as well as natural gas marketers for low-volume consumers within the Province.

As part of its role, the Ontario Energy Board oversees the electricity market within the Province, and ensures that all companies operating in the energy market adhere to the rules it assigns, thereby ensuring a certain minimum standard of service and financial performance.

Specifically, the Ontario Energy Board approves the delivery rates that distributors and transmitters are allowed to charge for the distribution and transmission of electricity. These delivery rates vary widely by region, depending on customer remoteness among other factors.

The membership of the Ontario Energy Board is composed of government-appointed nominees. These board members are quasi-independent of the industry and the Ontario Energy Board, but receive guidance from the Minister of Energy through the Stakeholder Advisory Committee (SAC).

Ontario Power Authority (OPA)

The Ontario Power Authority (OPA) was yet another independent non-profit corporation organized by the Government of Ontario to assist with matters in the provincial energy sector.

The Ontario Power Authority reported directly to the Ministry of Energy and was designed to be responsible for the planning of renewable energy, the procurement of new supply, and achieving the government-assigned targets for energy conservation and renewable energy.

The Ontario Power Authority was merged into the IESO in 2015 as the two organizations were largely performing similar tasks.

Ontario Power Generation (OPG)

Ontario Power Generation (OPG) is a successor company of Ontario Hydro and is a Crown corporation that is wholly owned by the Government of Ontario.xvii The OPG operates 74 generating plants in Ontario that produce electricity from various sources.

The primary source of electricity within the OPG’s portfolio is undeniably nuclear, with the rest of the supply coming from a variety of hydroelectric plants. In total, despite the fact that deregulation was meant to create competition in the generation of electricity in the Province of Ontario, the OPG still manages the production of over 70% of the Province’s electrical supply.

When combined with the 29% that is produced by Bruce Power, it is clear that the generation of electricity has hardly become deregulated yet in Ontario.

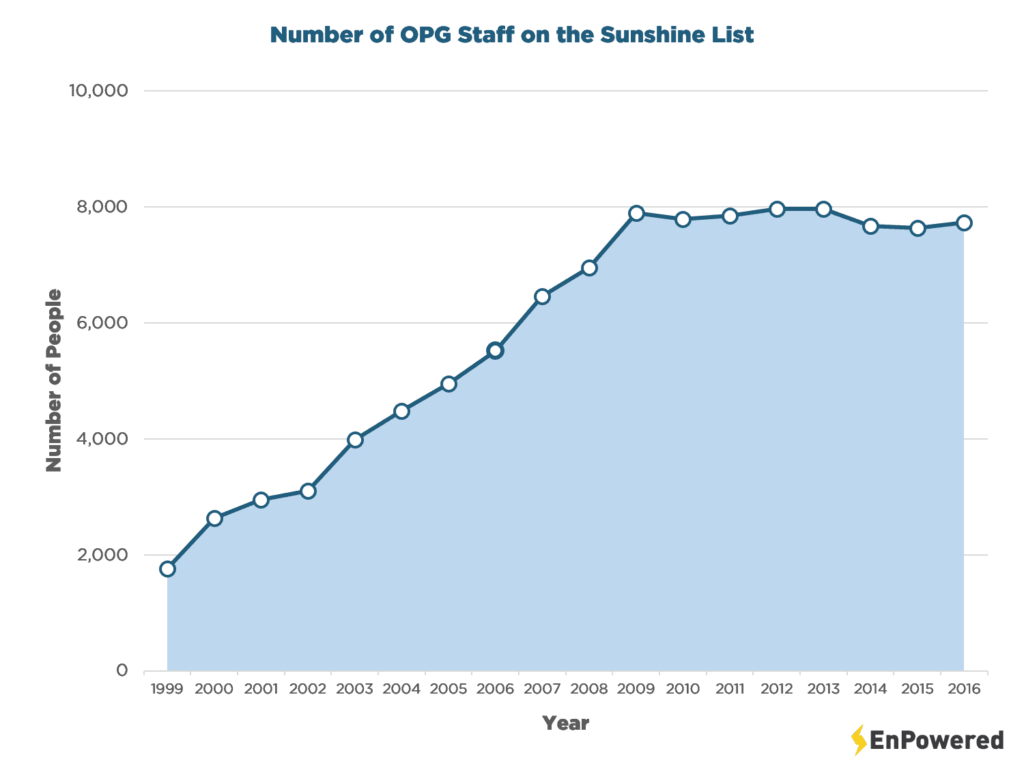

The OPG has also come under pressure for being home to many of Ontario’s highest compensated public-sector employees. The Auditor General of Ontario reported in 2013 that “compensation packages for OPG jobs are ‘significantly more generous’ than for comparable positions in the civil service.”xviii

Particularly, annual incentive awards at the OPG are up to $1.3 million, with pensions ranging from $180,000 to $760,000 per annum. OPG’s President and CEO earned $2,475,800 in 2008, with a total of 7,730 OPG employees being featured on the “Sunshine List” as of 2016. The designation of “Sunshine List” denotes Ontario public sector employees making $100,000 or more per year.

The total salary paid out by the taxpayer-funded OPG has been over $1 billion every single year since 2009.xviv

With that said, the phenomenon is not isolated to OPG alone. Various reports have indicated that a variety of non-profit publicly funded energy-related organizations in the Province of Ontario have executives being paid generous sums.

These nominally non-profit companies, composed of employees directly appointed by the Government of Ontario, “have a [direct] financial impact on the cost of electricity” in the Province of Ontario according to the Auditor General.xx

Electrical Safety Authority (ESA)

Finally, the Electrical Safety Authority (ESA) is also an independent, non-profit corporation that operates in Ontario and is responsible for electrical safety within the Province. It guides the safe usage of electricity and also coordinates inspections and product safety approvals.

Its primary role is identifying and targeting causes of safety risks in relation to electricity, promoting awareness of electrical risks, and generally improving electrical safety. Its board is composed of twelve members from the industry which have connections to various parts of the electrical system in Ontario.

Namely, they interface with members of the public, electric distributors, contractors, engineers, and manufacturing groups.

Read on here to understand how Ontario, which once had the cheapest electricity in all of North America, is now faced with businesses fleeing the Province due to rising electricity prices.

REFERENCES

i McKitrick, Ross, and Elmira Aliakbari. “Did the Coal Phase-out Reduce Ontario Air Pollution?” Fraser Institute, 17 Jan. 2017, www.fraserinstitute.org/studies/did-the-coal-phase-out-reduce-ontario-air-pollution.

ii Perkel, Colin. “Verdict Reached in Gas Plants Trial.” CP24, CP24, 19 Jan. 2018, www.cp24.com/news/verdict-reached-in-gas-plants-trial-1.3766407.

iii Love, Peter. A New Era in Electricity Conservation. Ontario, 2006, pp. 6, A New Era in Electricity Conservation.

iv Macaluso, Charlie. “Electric Market Primer.” Peterborough Utilities, Peterborough Utilities, Oct. 2006,www.peterboroughutilities.ca/Assets/PUSI+Assets/Documents/Electric+Utility/Ontario+Electric+Market+Primer.pdf.

v “Construction Cost Data for Electric Generators Installed in 2015.” Energy Information Administration, EIA.gov, 19 May 2017, www.eia.gov/electricity/generatorcosts/.

vi Schlissel, David, and Bruce Biewald. Nuclear Power System Plant Construction Costs. Synapse Energy Economics, Inc., July 2008, www.psr.org/nuclear-bailout/resources/nuclear-power-plant.pdf.

vii Morrow, Adrian. “Ontarians Paid $37-Billion above Market for Electricity over Eight Years, Auditor-General’s Report Says.” The Globe and Mail, 25 Mar. 2017, www.theglobeandmail.com/news/national/ontarians-paid-37-billion-above-market-price-for-electricity-over-eight-years-ag/article27560753/.

viii Find Your Local Distribution Company, IESO (Independent Electricity System Operator) Ontario Power System, Ontario Power System www.ieso.ca/Learn/Ontario%20Power%20System/Overview%20of%20Sector%20Roles/Find%20Your%20LDC.

ix Leslie, Keith. “Hydro One Sale Will Negatively Impact Ontario Budget: Watchdog.” CP24, 29 Oct. 2015, www.cp24.com/news/hydro-one-sale-will-negatively-impact-ontario-budget-watchdog-1.2633211.

x Block, Sheila. “Got a Problem? Privatize It (and Pay the Price for Selling off Hydro One Later).” Behind the Numbers, 16 Apr. 2015, http://behindthenumbers.ca/2015/04/16/got-a-problem-privatize-it-and-pay-the-price-for-selling-off-hydro-one-later/.

xi Harvey, Mark, and Grant Gelinas. “Customer Accuses Direct Energy of Misleading Sales Tactics.” CBC, 5 May 2015, www.cbc.ca/news/canada/edmonton/customer-accuses-direct-energy-of-misleading-sales-tactics-1.3057836.

xii “Consumer Ontario Energy Board Complaints about Energy Companies.” OEB, www.oeb.ca/consumer-protection/make-complaint/consumer-complaints-about-energy-companies.

xiii Lupton, Andrew. “Ontario Liberals Want to Ban Door-to-Door Electricity Retailers.” CBCnews, CBC/Radio Canada, 3 June 2015,www.cbc.ca/news/canada/toronto/ontario-to-ban-door-to-door-energy-marketers-1.3099265.

xiv Livesey, Bruce. “Canadian Energy Company Stalked by Controversy over Its Sales Methods.” Global News, 12 Nov. 2014, globalnews.ca/news/1656865/canadian-energy-company-stalked-by-controversy-over-its-sales-methods.

xv “Electricity Pricing Options.” Trusted Energy Provider – EnPowered | Electricity Pricing, EnPowered,www.enpowered.ca/HowItWorks/Electricity-Pricing.

xvi “Markets and Related Programs.” Real-Time Energy Market, Independent Electricity System Operator (IESO),www.ieso.ca/en/sector-participants/market-operations/markets-and-related-programs/real-time-energy-market.

xvii “Annual Report 2009.” Ontario Power Generation, OPG, 2009, www.opg.com/news-and-media/Reports/2009AnnualReport.pdf.

xviii Gunn, Frank. “OPG Fires 3 Executives after Auditor General’s Report.” CBC News, CBC/Radio Canada, 10 Dec. 2013,www.cbc.ca/news/canada/toronto/opg-fires-3-executives-after-auditor-general-s-report-1.2458723.

xix “Ontario Power Generation.” Ontario Sunshine List, 2017, www.ontariosunshinelist.com/employers/zdcn.

xx Babbage, Maria. “Sunshine List: Energy Execs among Ontario’s Highest Paid Public Sector Employees.” Global News, Global News, 28 Mar. 2014, globalnews.ca/news/1237232/sunshine-list-energy-execs-among-ontarios-highest-paid-public-sector-employees/.